On-chain Weekly Digest: Coinbase hints prediction market and stock trading on 17 Dec

Phantom announces desktop trading terminal, Monad mainnet launches with 50.6% of total MON token supply initially locked...

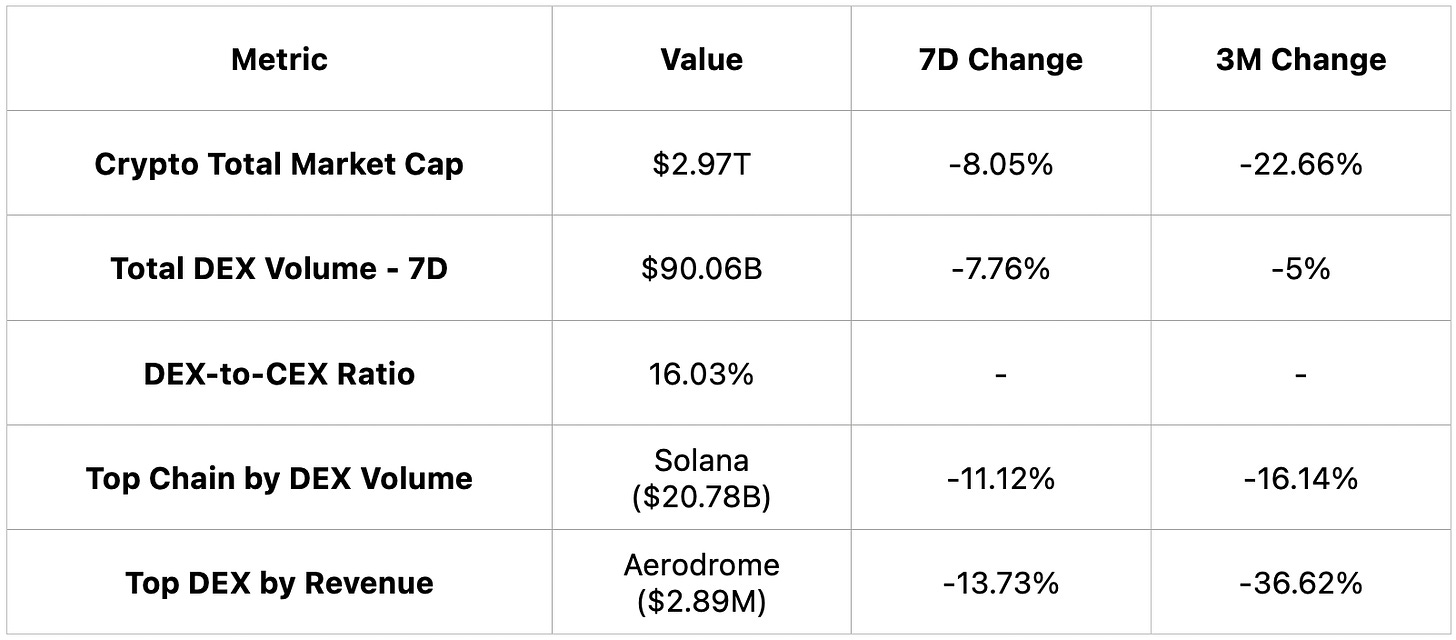

On-Chain Overview

Waller’s 25 bp cut call (81% possibility) and TGA drawdown fueled a short-lived rebound; crypto market cap –8.05%, DEX –7.76%, Avalanche volume +85%; funding rate negative, OI down, ETF flows divergent, with 91K–92K as key BTC resistance in a weak-bounce bear regime.

Crypto total market cap fell –8.05% (7D) and –22.66% (3M) to $2.97T, while DEX volume declined –7.76% (7D) to $90.06B and Solana remained the top chain by DEX volume ($20.78B, –11.12% 7D, –16.14% 3M), with Aerodrome leading by revenue ($2.89M, –13.73% 7D, –36.62% 3M).

(Data accurate as of: 24 Nov, 2025, 5:00 am, UTC)

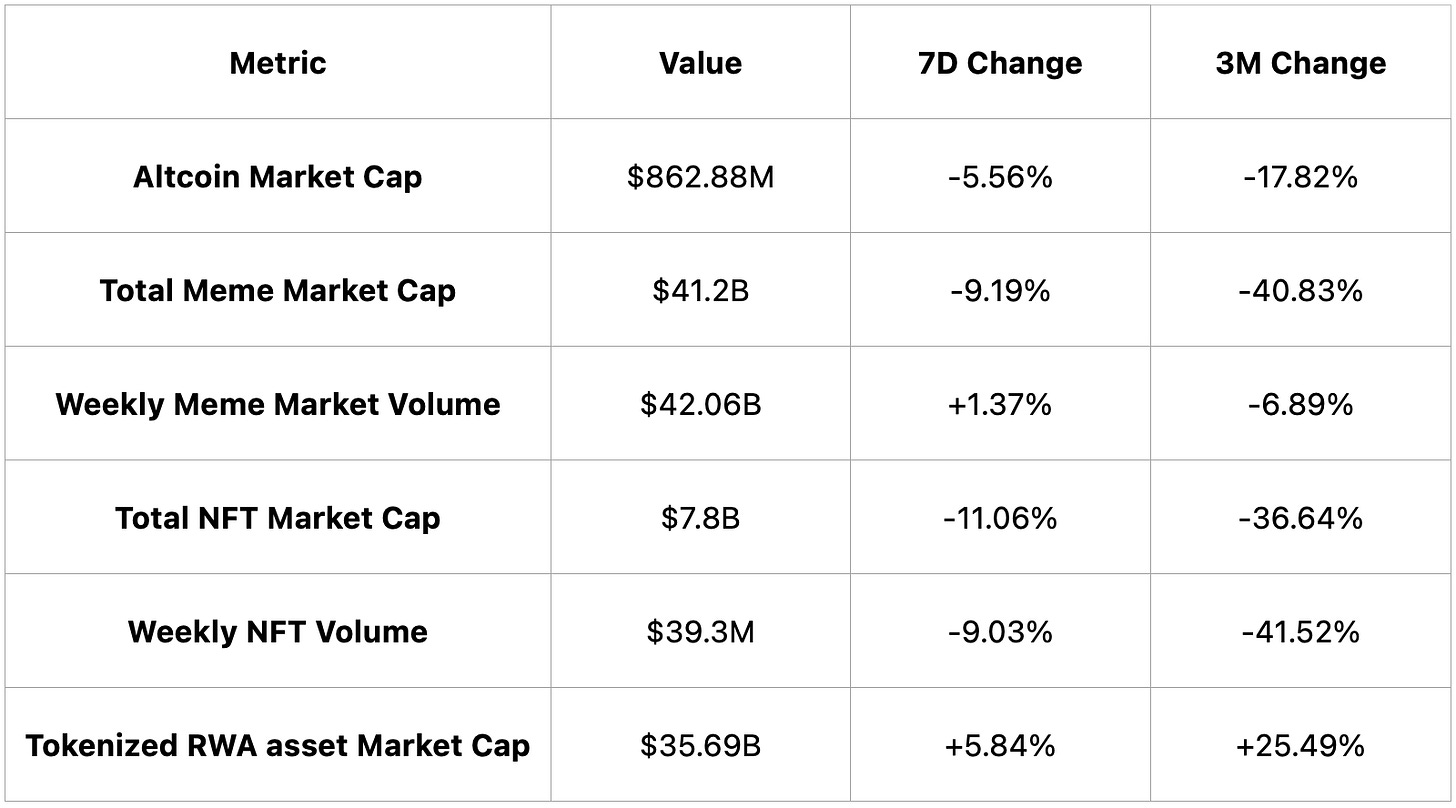

Altcoin, Meme coin, NFT and RWA

Altcoin market cap fell –5.56% (7D) and –17.82% (3M) to $862.88M, meme coins dropped –9.19% (7D) but trading volume rose +1.37% (7D), NFTs weakened sharply (–11.06% 7D, –36.64% 3M), while tokenized RWA assets stood out with +5.84% (7D) and +25.49% (3M) growth.

(Data accurate as of: 24 Nov, 2025, 5:00 am, UTC)

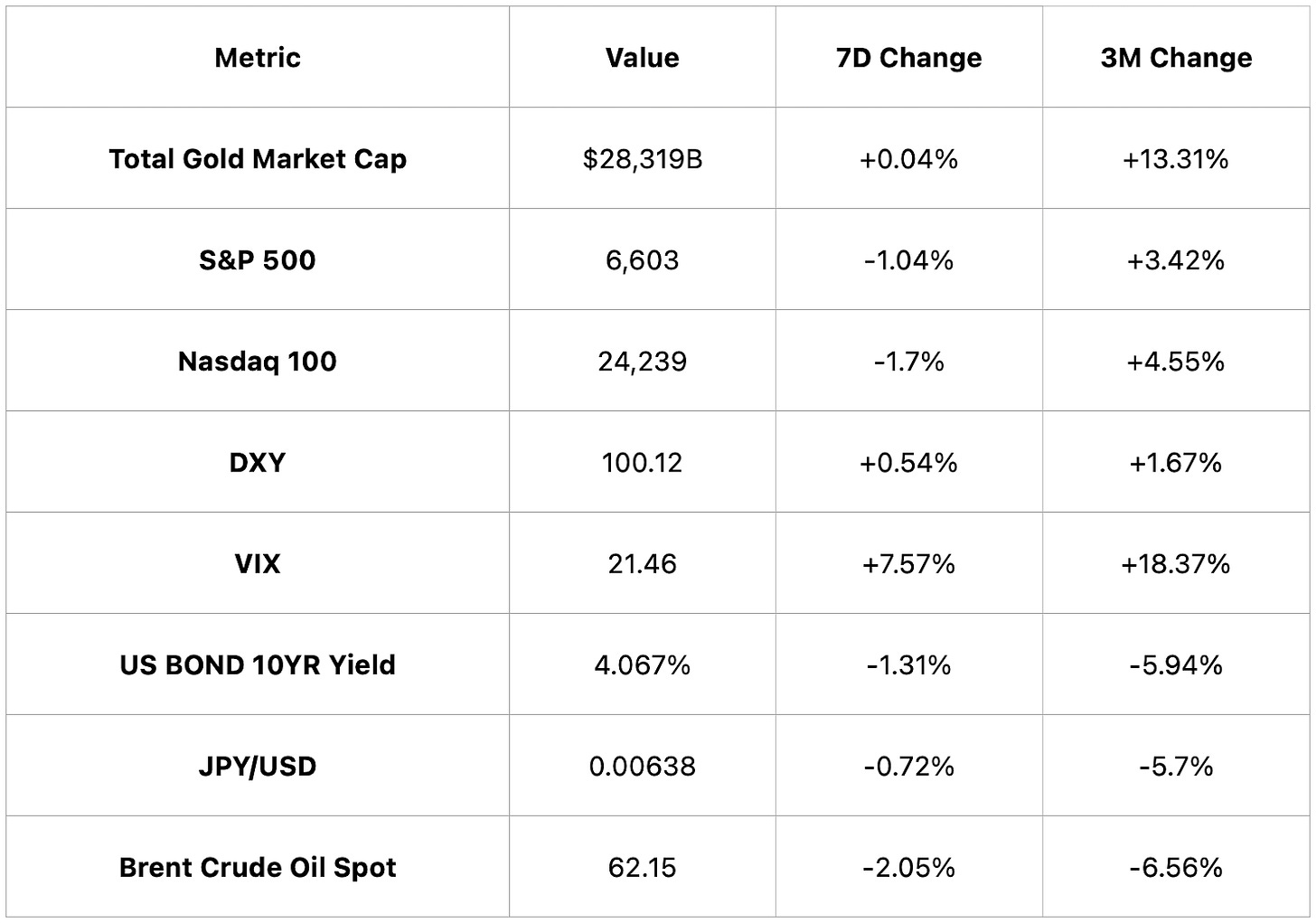

Macro, Stocks & Commodities

Gold stayed flat (+0.04% 7D) while gaining +13.31% (3M), equities softened (S&P 500 –1.04%, Nasdaq –1.7% 7D), DXY rose +0.54% (7D), VIX surged +7.57% (7D, +18.37% 3M), and bond yields (10Y –1.31% 7D) and oil (–2.05% 7D) both fell amid a mild risk-off shift.

(Data accurate as of: 24 Nov, 2025, 5:00 am, UTC)

Key Events of the Week

1. L2 | Coinbase updates their X bio to say “December 17”, hinting prediction market and stock trading (18 Nov)

2. Launchpad | Pump’s new ‘Mayhem Mode’ fails to boost token launches or revenue in first week (18 Nov)

3. Wallet | Phantom announces desktop trading terminal (19 Nov)

4. Meme | Coinbase is acquiring @VECTORDOTFUN, an onchain trading platform built on Solana (21 Nov)

5. L1 | Monad mainnet launches with 50.6% of total MON token supply initially locked (24 Nov)

Looking Ahead

L2 | MegaETH mainnet to be live in early December (Early Dec)

Key Takeaways

From a market data perspective: Market momentum weakened, total crypto cap dropped –8.05% (7D) to $2.97T, while RWA assets were the only segment showing +5.84% weekly gains amid lower OI, and diverging ETF flows.

From a market events perspective: Macro catalysts centered on Waller’s 25 bp rate-cut signal (81% possibility) and TGA liquidity release, while Coinbase’s Vector acquisition and Dec 17 trading hint, and Monad’s mainnet launch defined the week’s key project milestones ahead of MegaETH’s early-December debut.