On-chain Weekly Digest: LetsBonk’s daily graduates, active addresses, and revenue have all trended higher recently

Lighter’s LIT token rises 14% as protocol indicates active buyback, Punks rally, Smiling Cowboy Punk sells for $529k...

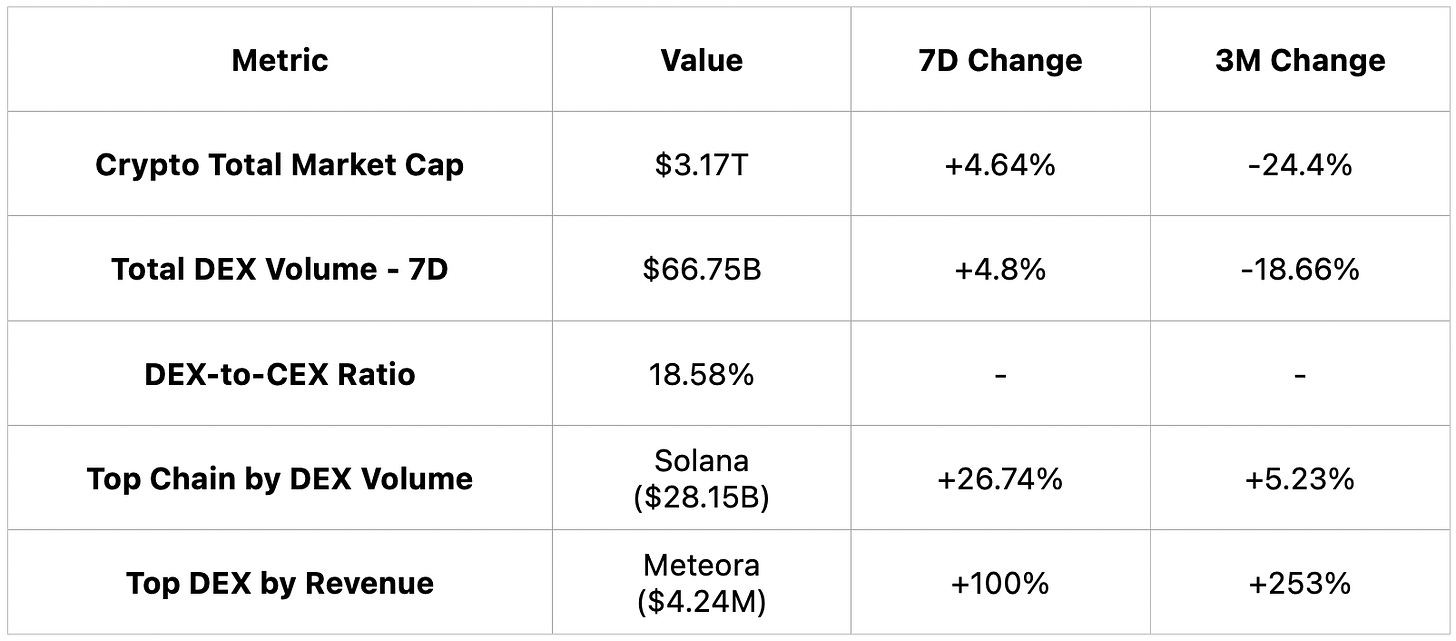

On-Chain Overview

BTC reclaimed the daily EMA50; Solana led 7-day DEX volume; meme tokens rebounded; BTC ETH and SOL ETF flows were net positive; Meteora posted the highest weekly DEX revenue while Pump.fun led launchpads revenue.

Crypto total market cap rose to $3.17T and 7D DEX volume to $66.75B, led by Solana at $28.15B and Meteora revenue of $4.24M, pointing to a short-term rebound.

(Data accurate as of: 5 Jan 2026, 10:00 am, UTC)

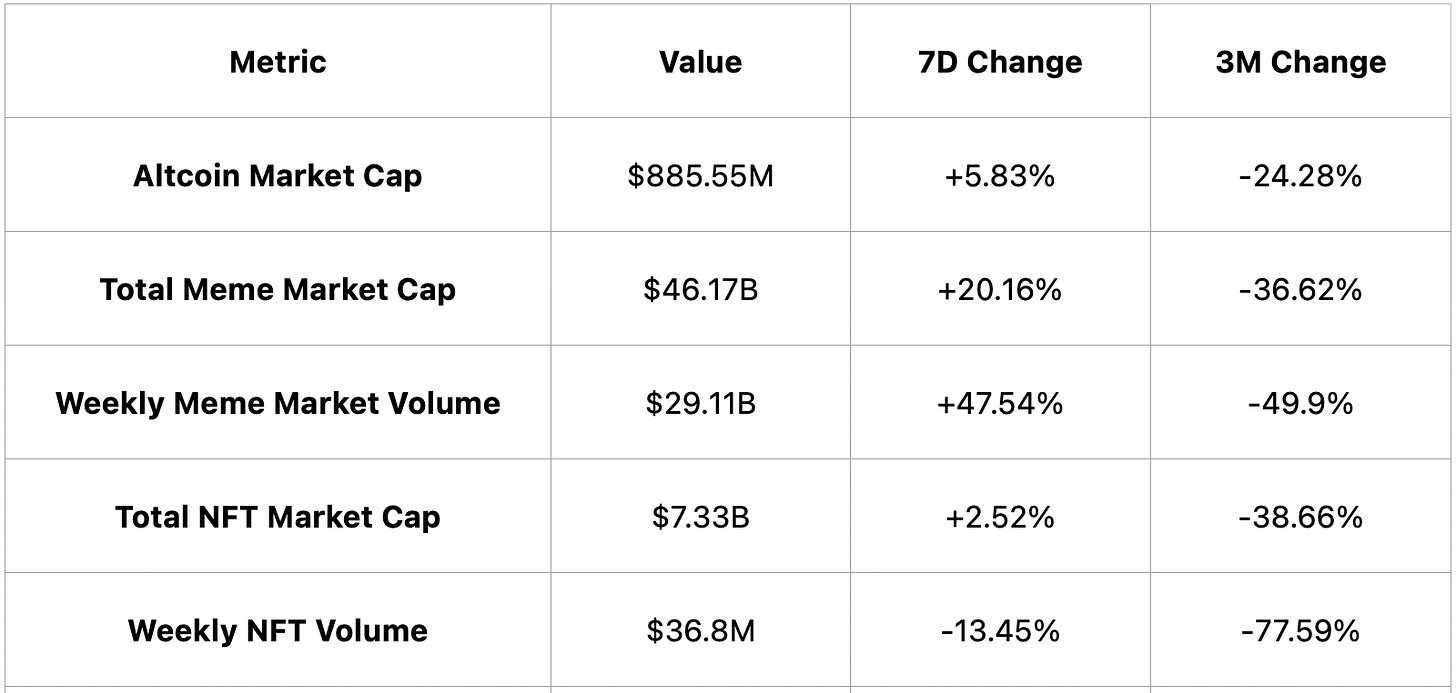

Altcoin, Meme coin, NFT and RWA

Altcoins rose to $885.55B, memes rebounded +20.16% to $46.17B market cap and $29.11B weekly volume, while NFTs stayed weak at $7.33B cap with volume down to $36.8M.

(Data accurate as of: 5 Jan 2026, 10:00 am, UTC)

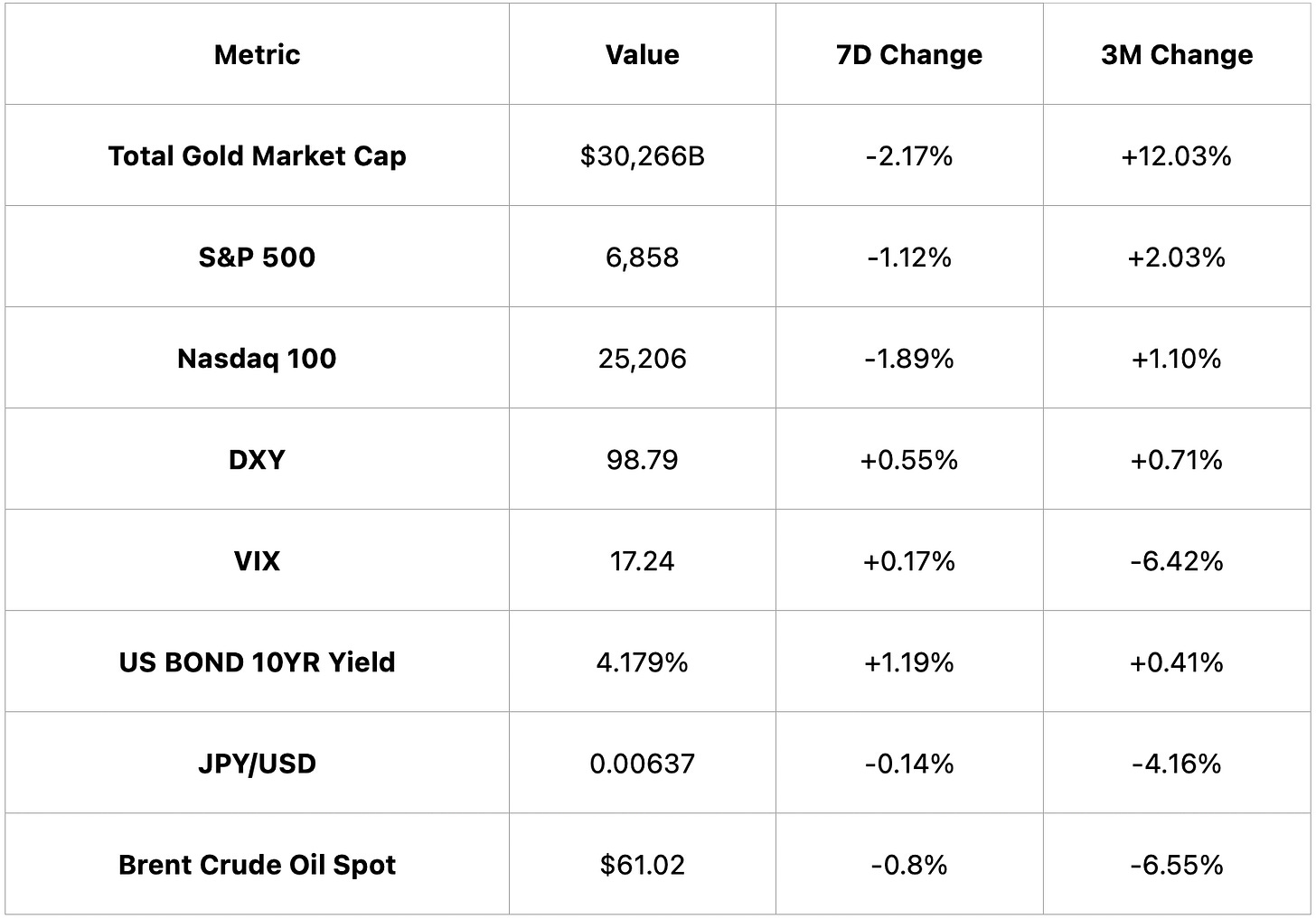

Macro, Stocks & Commodities

Global macro indicators showed divergent performance, with gold went down to $30.27T, while the DXY strengthened to 98.79 and US 10Y yields rose to 4.179%, alongside a softer JPY/USD at 0.00637 and Brent crude at $61.02.

(Data accurate as of: 5 Jan 2026, 10:00 am, UTC)

Key Events of the Week

1. Launchpad | LetsBonk’s daily graduates, active addresses, and revenue have all trended higher recently (5 Jan)

2. Defi | Aave Labs is committed to sharing revenue generated outside the protocol with token holders (2 Jan)

3. DEX | Jupiter team proposes to stop buyback (3 Jan)

4. DEX | Lighter’s LIT token rises 14% as protocol indicates active buyback (6 Jan)

5. NFT | Punks rally, Smiling Cowboy Punk sells for $529k (4 Jan)

Key Takeaways

From a market data perspective: Crypto market cap reached $3.17T and 7-day DEX volume $66.75B with Solana leading ($28.15B), Meteora topped weekly revenue ($4.24M), memes rebounded while NFTs stayed weak, and ETF flows were net positive.

From a market events perspective: LetsBonk activity climbed, Aave Labs said it will share revenue generated outside the protocol with token holders, Jupiter proposed halting buybacks, and LIT rose 14% on buyback expectations.