On-chain Weekly Digest: Ondo’s lead in tokenized U.S. government securities

Jupiter’s acquisition of Drip Labs and PumpFun’s live streaming relaunch…

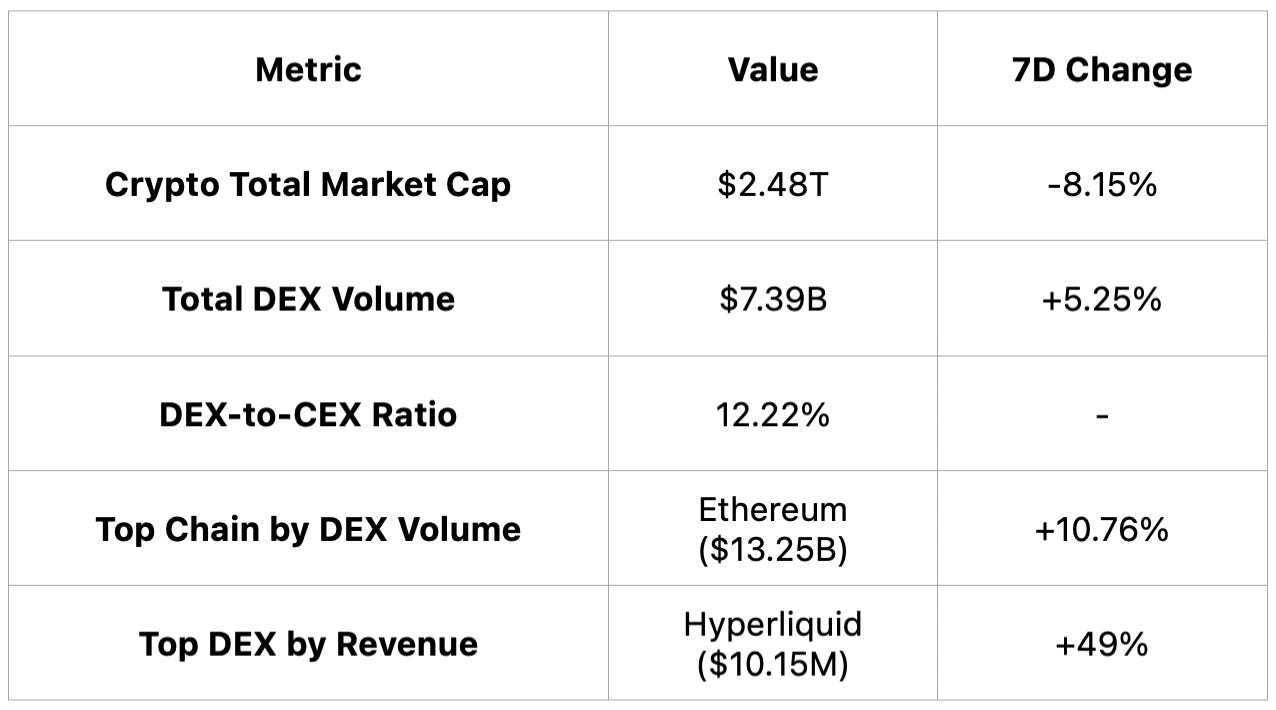

On-Chain Overview

Crypto narratives are shifting from tech to macro and ideology, with market trends increasingly driven by liquidity, risk appetite, and leverage mechanisms. US tariff negotiation can trigger short-term volatility and forced liquidations.

Despite an 8.15% drop in total crypto market cap, DEX activity remains resilient with a 5.25% volume increase, led by 10.76% increase of Ethereum DEX Volume and by a 49% revenue surge on Hyperliquid.

(Data accurate as of: April 7, 2025, 14:00)

Altcoin, Meme Coin, NFT & RWA

Altcoins and meme coins saw sharp market cap declines, but meme and RWA sectors showed strong volume rebounds, highlighting speculative interest despite broader risk-off sentiment.

(Data accurate as of: April 7, 2025, 14:00)

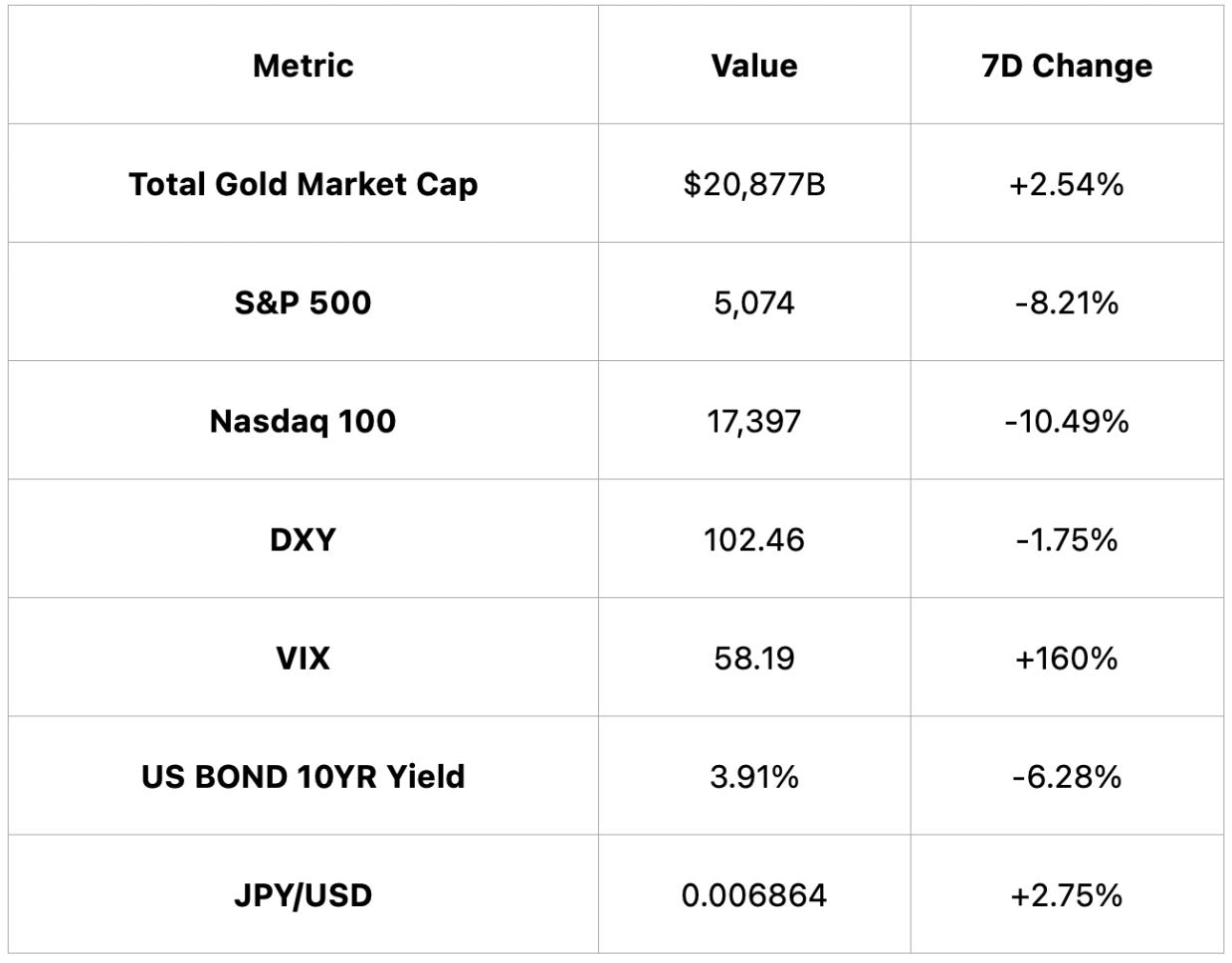

Macro, Stocks & Commodities

Risk-off sentiment dominated traditional markets, with sharp drops in equities and bond yields, surging volatility (VIX +160%), and a flight to safety reflected in rising gold and JPY.

(Data accurate as of: April 7, 2025, 14:00)

Key Events of the Week

CEX | Many coins drop 20-60% suddenly on Binance (2 APR)

After Binance adjusted leverage settings, ACT, TST, MASK, LEVER, and several other tokens have seen a sharp and rapid short-term decline.

NFT | Jupiter purchases Drip Labs, expands into NFTs (2 APR)

Their mission is to build a better internet for creators through digital ownership and crypto payments.

RWA | OndoFinance now leads the tokenized U.S. government securities (5 APR)

@OndoFinance now leads the tokenized U.S. government securities space with $721M in assets, flipping Franklin Templeton and Hashnote.

Launchpad | PumpFun live streaming is back online for 5% of users (5 APR)

Pumpfun reintroduces live streaming for 5% of users, featuring "industry standard moderation systems and transparent guidelines".

L1 | Ripple’s XRP network experienced a +490% spike in address activity from cycle low (2 APR)

A near-doubling of Realized Cap since cycle low, signaling aggressive retail interest.

Looking Ahead

ETH | SEC to approve Blackrock ETH options trading (15 APR)

This will affect Ethereum's trading capabilities and market dynamics.

NFT | The Pudgy NYC X Solana Skyline Event (18 APR)

The Pudgy NYC X Solana Skyline Event is a collaboration for an exclusive Happy Hour event.

Meme | $TRUMP token will have an unlock (18 APR)

$TRUMP token will have an unlock event on April 18, releasing 40,000,000 TRUMP tokens valued at $1.60 billion.

Wrapping Up

From a market data perspective: Macro factors, liquidity, and leverage are driving trends; despite an 8.15% market cap drop, DEX, meme, and RWA sector volume remain increasing, showing speculative strength amid risk-off sentiment.

From a market events perspective: Binance’s leverage tweak hit tokens; Ondo leads treasuries, PumpFun returns for 5%, XRP activity surges. Key events ahead include BlackRock’s ETH options approval, $TRUMP token unlock, and major NFT activations, while XRP activity and RWA growth signal shifting market focus.