On-chain Weekly Digest: OpenSea unveils first NFT reserve

Pump.fun partners with MEXC for weekly ecosystem listings, Native Markets officially claims Hyperliquid’s USDH stablecoin ticker...

On-Chain Overview

Solana ecosystem led a market-wide rally last week, with Forward Industries executing the largest ever SOL DAT buy. BTC/ETH ETFs hit record all-time-high total volume. Meanwhile, sectors like Base and Doge ETF gained increasing attention.

Crypto market capitalization rose 5.47% to $4.05T alongside a 13.45% increase in DEX volume, with Solana leading chains ($30.49B, +23.04%) and Hyperliquid topping DEX revenue ($20.14M, +24.09%).

(Data accurate as of: Sep 15, 2025, 7:00 am, UTC)

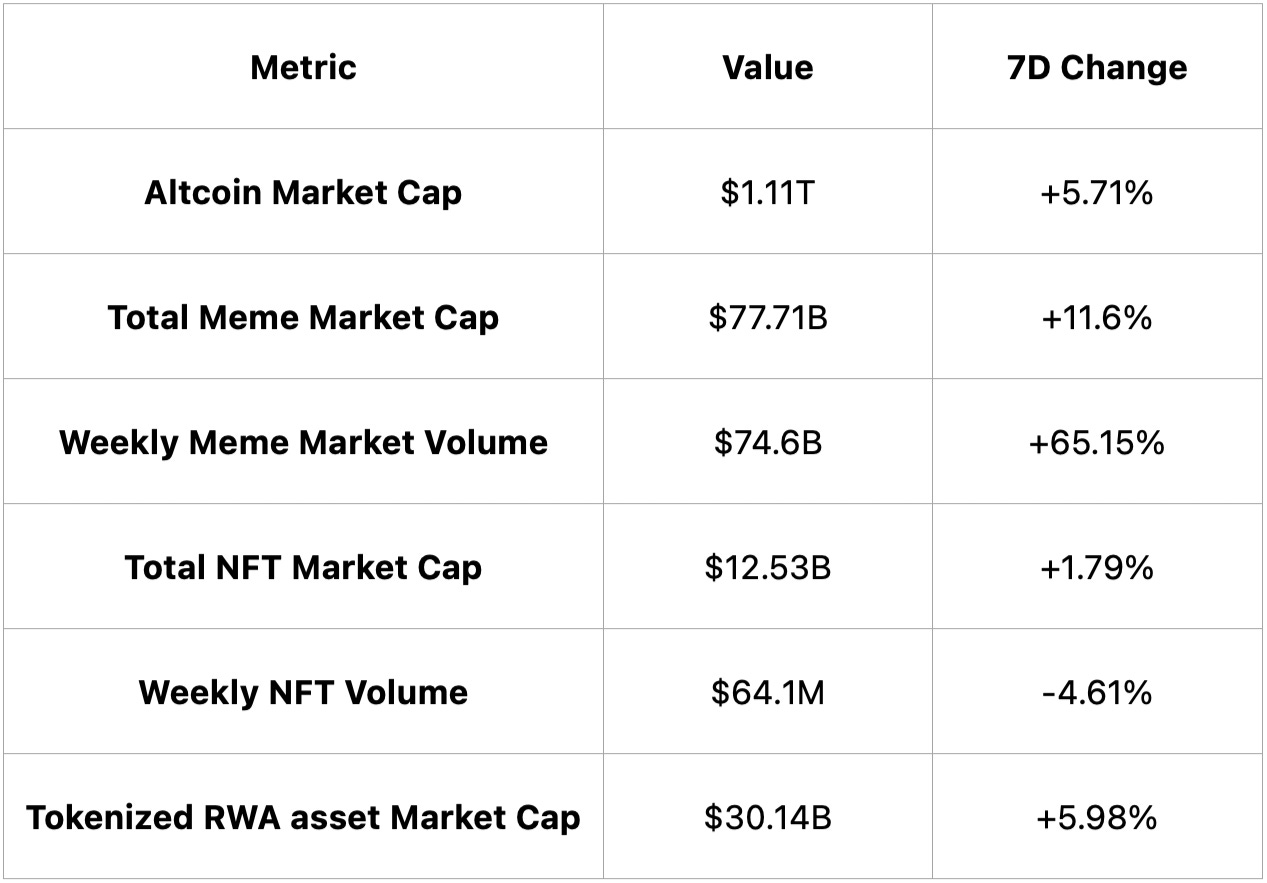

Altcoin, Meme coin, NFT and RWA

Altcoin sector gained momentum (+5.71%), driven by a 65.15% surge in meme trading volume, while NFTs stagnated and tokenized RWAs saw an increase of 5.98%.

(Data accurate as of: Sep 15, 2025, 7:00 am, UTC)

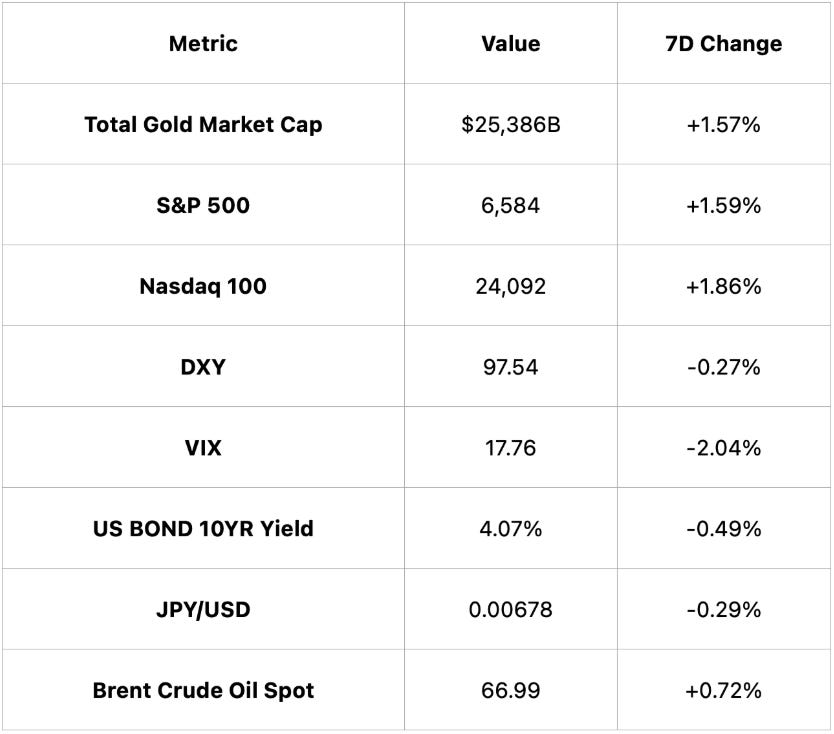

Macro, Stocks & Commodities

Gold, equities, and oil edged higher amid a softening dollar, falling bond yields, and declining volatility, signaling a broadly risk-on macro environment.

(Data accurate as of: Sep 15, 2025, 7:00 am, UTC)

Key Events of the Week

NFT | OpenSea unveils first NFT reserve (8 Sep)

As part of the SEA token launch, OpenSea will start sweeping millions in tokens and NFTs into a massive prize vault, beginning with the purchase of CryptoPunk #5273, using 50% of all platform fees starting Sept. 15.

Launchpad | Pump.fun partners with MEXC for weekly ecosystem listings (8 Sep)

MEXC kicks off MEXC Mondays in partnership with Pump.fun by listing a new ecosystem coin every Monday, starting with Week 1’s debut of Trencher Broadcasting Company.

Stablecoin | Ethena ecosystem surges with listings, buybacks, and new stablecoin launches (14 Sep)

Ethena’s USDe is now listed on Binance with supply surpassing $13B, enabling a potential $500M ENA buyback; StablecoinX raised $530M to purchase over 3B ENA, MegaMatrix filed a $2B shelf, and MegaETH Labs launched USDm atop Ethena’s infrastructure.

Defi | Aave TVL on Linea soars 73x amid incentive-fueled growth (14 Sep)

Aave’s TVL on Linea skyrocketed from $26M to $1.91B between early August and Sept 11, fueled by Linea Ignition incentives targeting WETH, USDC, and USDT pools with ZK-verified rewards, boosting Aave’s total market size to nearly $70B.

L2 | Base explores issuing native token, says creator Jesse Pollak (15 Sep)

At the BaseCamp event, Jesse Pollak revealed the layer-2 network is considering a native token, though plans remain in early stages.

Prediction Market | Polymarket token could be coming soon (16 Sep)

Polymarket has filed a form with the SEC indicating that “other warrants” were offered in its latest raise — a term typically used to imply tokens — potentially signaling the launch of a Polymarket token, according to the filing.

Stablecoin | Native Markets officially claims Hyperliquid’s USDH stablecoin ticker (15 Sep)

Native Markets, one of the teams that submitted a proposal to issue and manage the Hyperliquid crypto exchange’s US dollar stablecoin (USDH), officially claimed the USDH ticker on Sunday, following a community vote.

Looking Ahead

L1 | Ethereum's Fusaka upgrade is scheduled from September 22 to early November (29 Sep)

Ethereum devs agree on Fusaka upgrade timeline for early November mainnet launch, with public testnet upgrades starting late September.

Wrapping Up

From a market data perspective: Crypto market capitalization rose 5.47% to $4.05T, DEX volume increased 13.45%, with Solana leading at $30.49B (+23.04%) and Hyperliquid topping DEX revenue at $20.14M (+24.09%).

From a market events perspective: Solana ecosystem rallied on Forward Industries’ record SOL DAT buy, while BTC/ETH ETFs hit all-time-high Market Cap; Base, Doge ETF, and NFT initiatives like OpenSea Reserve gained traction.