Weekly Review: Yuga Labs' case closed by SEC, market reaction to Crypto Summit in White House, and Bitcoin reserve order...

NFT Weekly News #87 4th March- 10th March

NFT News Weekly Update #87

(04/03/2025-10/03/2025)

GM

Welcome to NFT Weekly News by Threekeyslab🗝️🗝️🗝️. Subscribe and follow to stay up-to-date with key market digests.

Top News 🔝

📌 US regulation | SEC concludes Yuga Labs, Bored Ape Yacht Club investigation with no charges (04 Mar)

The SEC was reportedly investigating whether Yuga Labs’ NFT collections, including Bored Ape Yacht Club and related assets, were marketed in a way that could be considered an investment contract under the Howey Test.

With the SEC’s decision to close the case without any charges, Yuga Labs and the NFT industry at large see the move as a significant regulatory victory.

📌 Crypto Macro | XRP, ADA, SOL Fall Harder Than BTC as White House Crypto Summit Disappoints Traders (8 Mar)

The White House Crypto Summit, led by President Trump, ended without the expected bold announcements about a U.S. strategic crypto reserve, leading to a decline in altcoins like XRP, ADA, and SOL.

The summit resulted in a framework for stablecoin legislation by August and a promise of lighter regulation, but these outcomes did not stimulate the market as anticipated.

Despite the market's reaction, the U.S. government's decision to hold onto its bitcoin could set a precedent for other countries and potentially drive global institutional adoption of cryptocurrencies.

📌 Crypto Macro | Trump Orders Bitcoin Reserve and Digital Assets Stockpile (7 Mar)

President Donald Trump ordered a bitcoin reserve set up for U.S. holdings.

The executive order will also establish a crypto stockpile for other types of assets. All of the involved assets will, initially, only include those seized in civil and criminal cases. Crypto prices fell sharply in the minutes following the announcement.

Market Update 📣

Last week, the primary NFT PFP projects that saw significant sales included Crypto Punks and Azuki.

In the realm of Art NFTs Fidenza, Beeple: everydays - the 2020 collections and Remnants have made the list. Notably, Fidenza has reached a selling price of 38 ETH.

Source: NFTPriceFloor

Other News 👀

📌 L1 | AVAX activity hits yearly peak after $BLUB (5 Mar)

AVAX has seen a sharp increase in active wallets. AVAX reached 350k unique activities on Tuesday, its highest level in a year and 3x its local average. This comes amidst the memecoin presale hype playing out with $KET, $WINK and now $BLUB.

📌 NFT | Punks see 23 sales in 24hrs (6 Mar)

📌 Prediction market | Polymarket Stalls on BTC Reserve Market Despite Trump’s Executive Order (8 Mar)

Crypto-based prediction platform Polymarket's market on whether President Donald Trump would establish a US Bitcoin reserve within his first 100 days in office remains unresolved, frustrating traders. The bet noted that the confiscation of Bitcoin by the U.S. government does not count as holding reserves.

📌 Data | Arkham Launches New Tag to Track Crypto Influencers’ Wallets (08 Mar)

Blockchain analytics firm Arkham Intelligence has introduced a new tagging system to track cryptocurrency transactions of Key Opinion Leaders with over 100,000 followers on their platform. The new feature currently includes 950 addresses, with notable figures such as Ethereum co-founder Vitalik Buterin, crypto entrepreneur Justin Sun, and U.S. President Donald Trump among those identified.

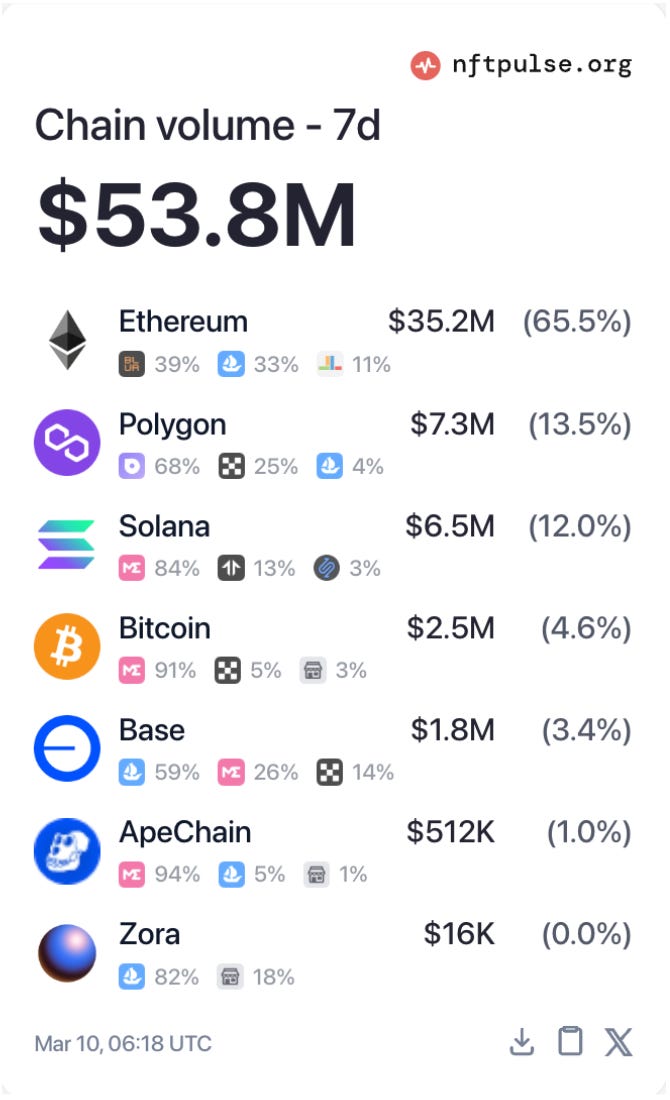

NFT Chain Volume 💎

Over the past week, NFT marketplace volume went down to $53.8M from $70.9M one week ago.

Ethereum claimed the top spot with a 65.5% market share while with $35.2M chain volume. Polygon and Solana are ranked 2nd and 3rd, with $7.3M and $6.5M chain volume respectively.

The Weekly Top 3 NFT PFP projects by trading volume are Courtyard.io, Crypto punks and Pudgy Penguins, with 7-day trading volumes of 19.5M POL, 1.8K ETH, 1.8K ETH respectively.

Credit to : @NFTpulse

Memecoin Market Cap and Volume 🔑

Over the past week, the market cap for memecoins reached $48.49B on March 10th, marking a 19.19% decrease from the previous week. We see a bounce back on the 10th of March.

Meanwhile, daily trading volume came to $6.78B on March 10th, reflecting a 54.17% decrease compared to last week.

Credit to : @CoinMarketCap